Table of Contents

- VOO Stock Price and Chart — AMEX:VOO — TradingView

- Here's Why You Should Buy Vanguard ETFs During the Market Meltdown ...

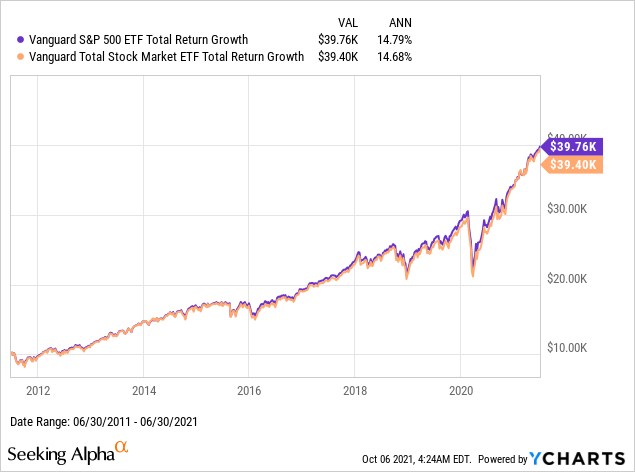

- VOO vs VTI Which ETF Would You Choose? - The Frugal Expat

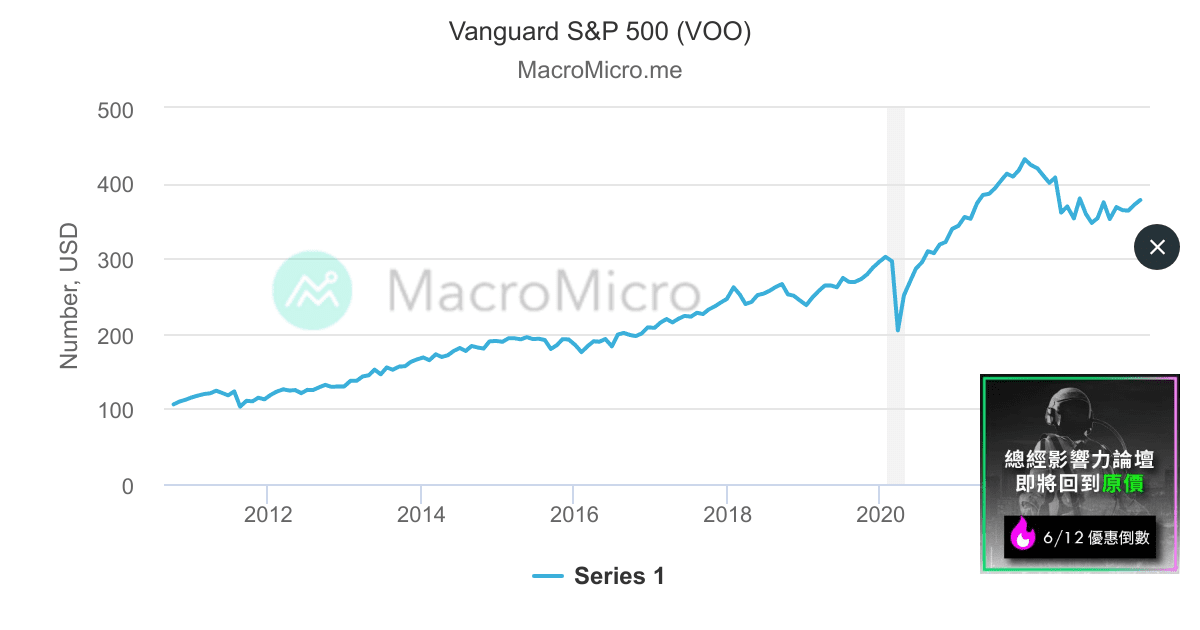

- Vanguard S&P 500 (VOO) | MacroMicro

- 미국 인기 ETF 주식 5개 종목 - 불주사

- VOO Stock Price and Chart — AMEX:VOO — TradingView

- VOO ETF Stock Review | Vanguard S&P 500 ETF - YouTube

- VOO Review: Is VOO a Good ETF to Invest In? - Thoughtful Finance

- Vanguard VOO ETF: S&P 500 Next 10-Year Annual Returns Likely 2-5% ...

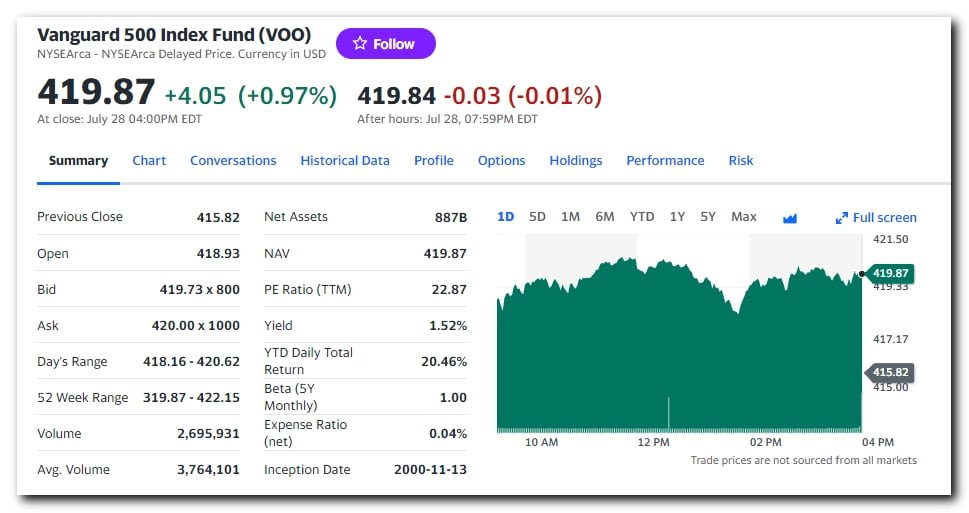

- Vanguard 500 Index Fund (VOO) Stock Price, News, Quote & History ...

What is VOO ETF?

Benefits of Investing in VOO

Key Features of VOO

Some key features of VOO include: Index Tracking: VOO tracks the S&P 500 Index, which is widely considered to be a benchmark for the US stock market. Low Turnover: The fund has a low turnover rate, which means that it doesn't buy and sell stocks frequently, reducing trading costs. No Minimum Investment: There is no minimum investment requirement to invest in VOO, making it accessible to investors of all sizes. Tax Efficiency: VOO is designed to be tax-efficient, with a low turnover rate and a focus on long-term investing.

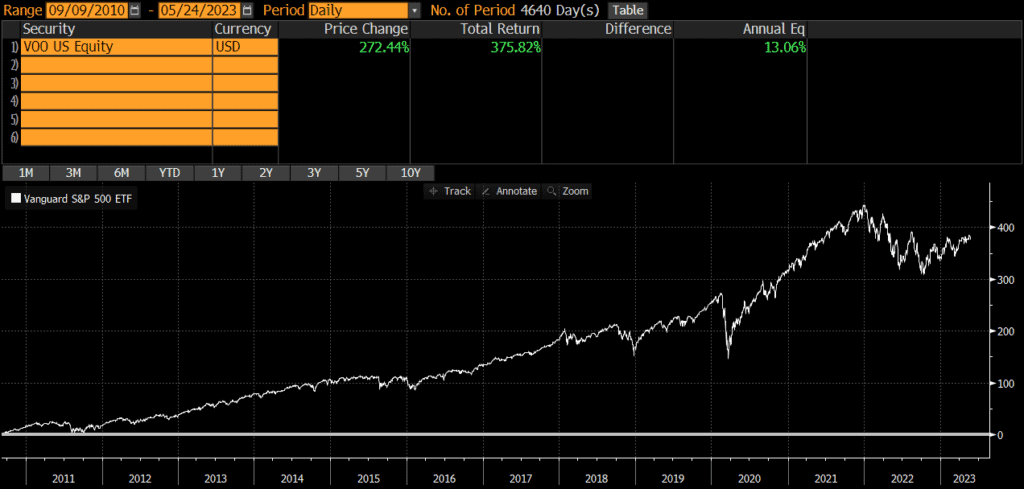

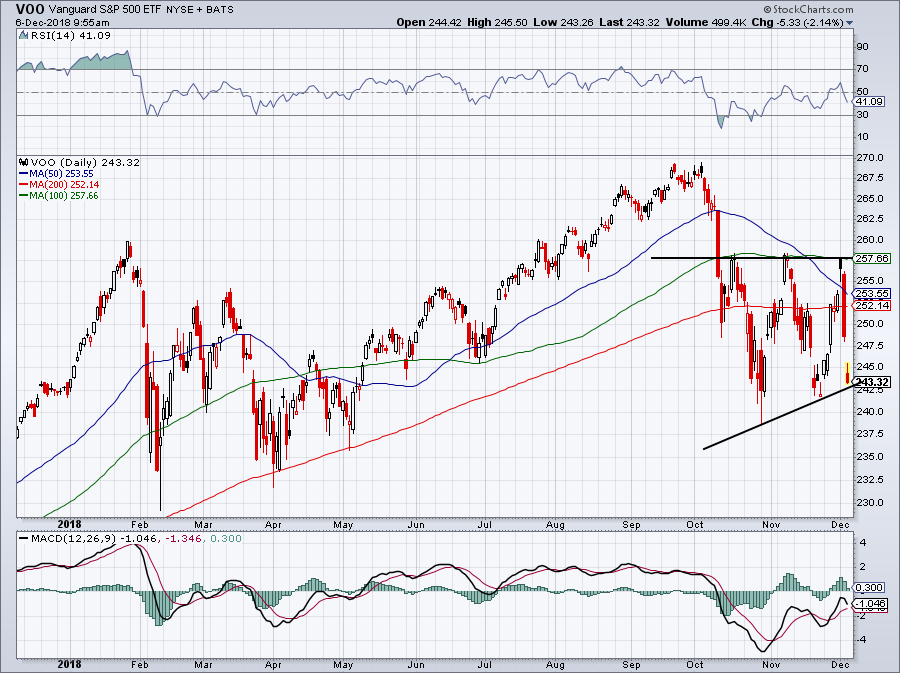

Performance of VOO

VOO has consistently delivered strong performance over the years, with a long-term track record of outperforming many actively managed funds. According to MarketWatch, VOO has a 1-year return of 13.65%, a 5-year return of 10.35%, and a 10-year return of 13.45%. In conclusion, VOO is a popular and widely traded ETF that provides investors with a diversified portfolio of 500 of the largest and most stable companies in the US stock market. With its low costs, flexibility, and transparency, VOO is an attractive option for investors looking to track the performance of the S&P 500 Index. Whether you're a seasoned investor or just starting out, VOO is definitely worth considering as part of your investment portfolio.For more information on VOO and other ETFs, visit MarketWatch for the latest news, data, and analysis.